Market Update: November 04, 2021

After two thematic pieces, we return to a market commentary this month.

Contextualizing Current Market Strength

We start by revisiting the state of the current ascent, 19 months off the bottom. Figure 1 shows rallies off the bottom in 1982, 2009, and 2020. The gap between the 2021 ascent and prior ascents remains wide, despite a plateau between July 20 and October 5 (indicated by the red line).

Figure 1. The current rally remains historically dominant even with the seasonal pause.

Source: FactSet and Balentine

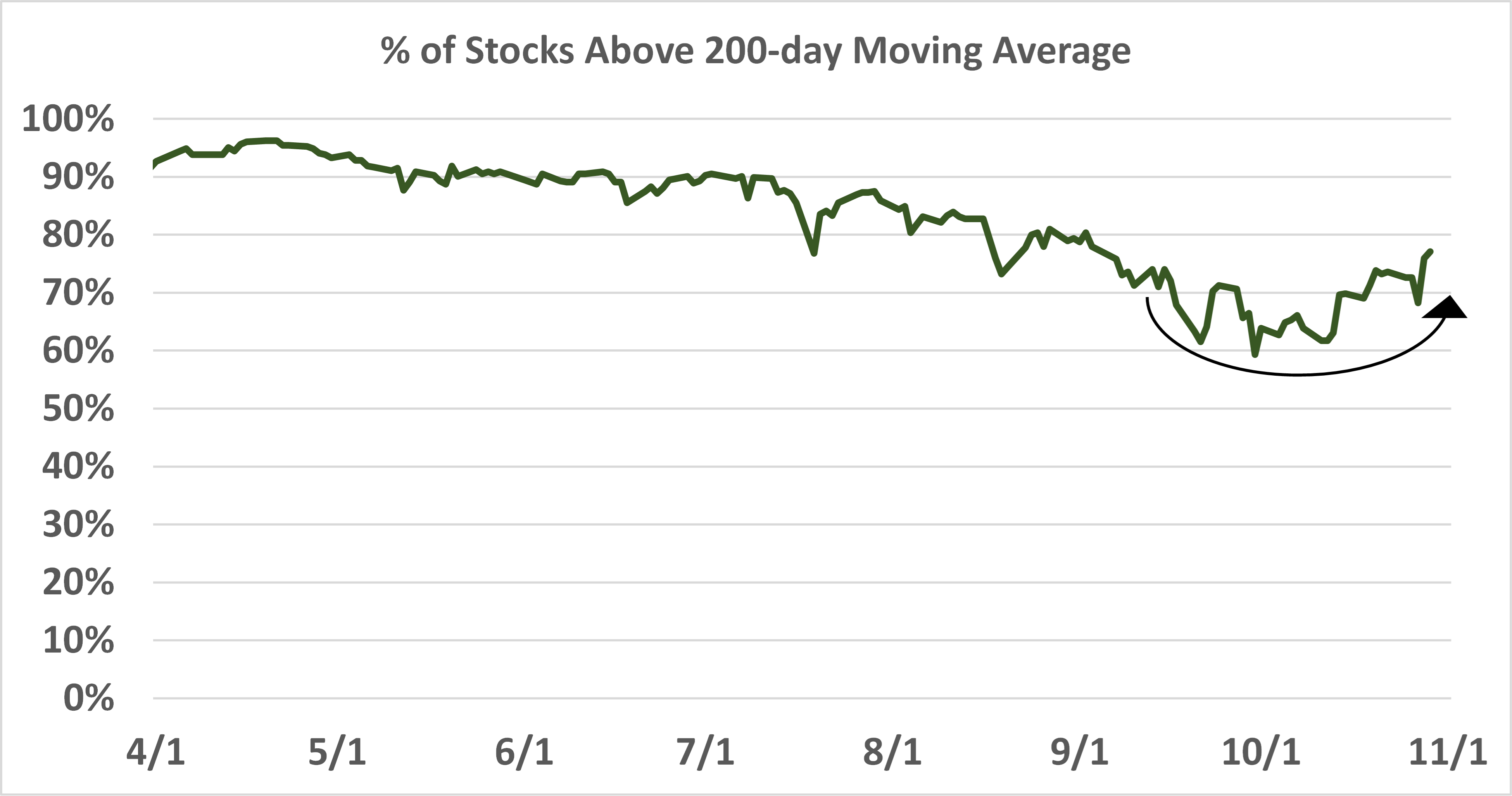

With this weak seasonal period in the rearview mirror, the market under the surface is looking stronger. The graphs in Figure 2 indicate that breadth is improving as more stocks show strength, evidenced by the growing percentage of stocks above average market prices in the past few months. Over the summer, index levels improved on less and less involvement. Now we are seeing the market ascend on improved participation, as the equal-weighted S&P index broke a new high (Figure 3). Note that this is not just a U.S. phenomenon. Global markets are showing absolute strength and broadening participation as well.

In addition to onsetting seasonal tailwinds, reasons for the strength include:

- monetary policy that remains accommodative even as global central banks discuss tapers and potential interest rate increases, and

- economies that, while not overly robust, are surpassing relatively low expectations owing to structural concerns about rolling virus waves and supply chain bottlenecks.

Figure 2. More stocks are showing up trends and strong momentum.

Source: FactSet and Balentine

Figure 3. The equal-weight S&P has punched to new highs, speaking to how broad the advance is.

Source: FactSet

Considerations Moving Forward

So, under the context of a market that looks like it’s getting going again, following are some brief thoughts of which to be mindful.

- In the fixed income market, yields appear to be moving higher, and we suspect it is only a matter of time before they break through the to-date cycle high of 1.77% from March (Figure 4). Rising yields are likely is a function of inflation expectations and a result of economic growth resuming above heretofore lowered expectations. And, as with the equity markets, this is a global phenomenon; yields are breaking out across the globe, in some cases with yields that had gone negative now turning back positive. This should have a disproportionately positive impact on stocks of the more cyclical companies.

- On the back of rising interest rates, it is not surprising that two areas leveraged to lower rates, utilities and staples, are struggling. However, we think there is more to the weakness in these areas than just the rate story, as stock prices in those sectors struggled as rates fell, which should not have been the case. It’s just a general environment where investors are shunning lower beta securities.

- The price of WTI crude oil remains strong although it seems to have hit a bit of a wall over the last two weeks in the $82-$85 range. The key question is: how much is the higher oil price impacting consumers and the economy? We suspect consumer discretionary stocks will be the first to tell us when the oil price is becoming a problem. So far, these stocks do not indicate that there is an issue. The state of restaurant stocks could foretell what an issue may look like in the consumer discretionary space; they are being hit with a double whammy of a higher input costs (e.g., energy, food, and labor) and supply chain bottlenecks.

- Concerns in China remain regarding 1) government intervention in the markets (particularly in the education space, and 2) debt concerns and their impact on the property market. With that said, the Hong Kong property index is up about 20% since the Evergrande crash, bringing it back to around the level prior to the crash. We do not think the debt problems are out of the woods yet, but things have stabilized for the moment, and importantly credit spreads are not indicating anything sinister is on the imminent horizon. Additionally, the recent strengthening of the offshore Chinese yuan provides further evidence that things are relatively copacetic in China at the moment, especially given the context of a weakening yen.

Figure 4. Seems to be just a matter of time for interest rates before they break recent highs.

Source: FactSet

Browse our collection of resources from trusted thought leaders.

Balentine experts offer their authentic take on the latest financial topics, including our exclusive market publications, news, community events, and more.

%20(1).png)

.png)

.png)

%20(1).png)